The MEbA Biodiversity Platform:

Agriculture Lending including Climate and Biodiversity ImpactsSupported by:

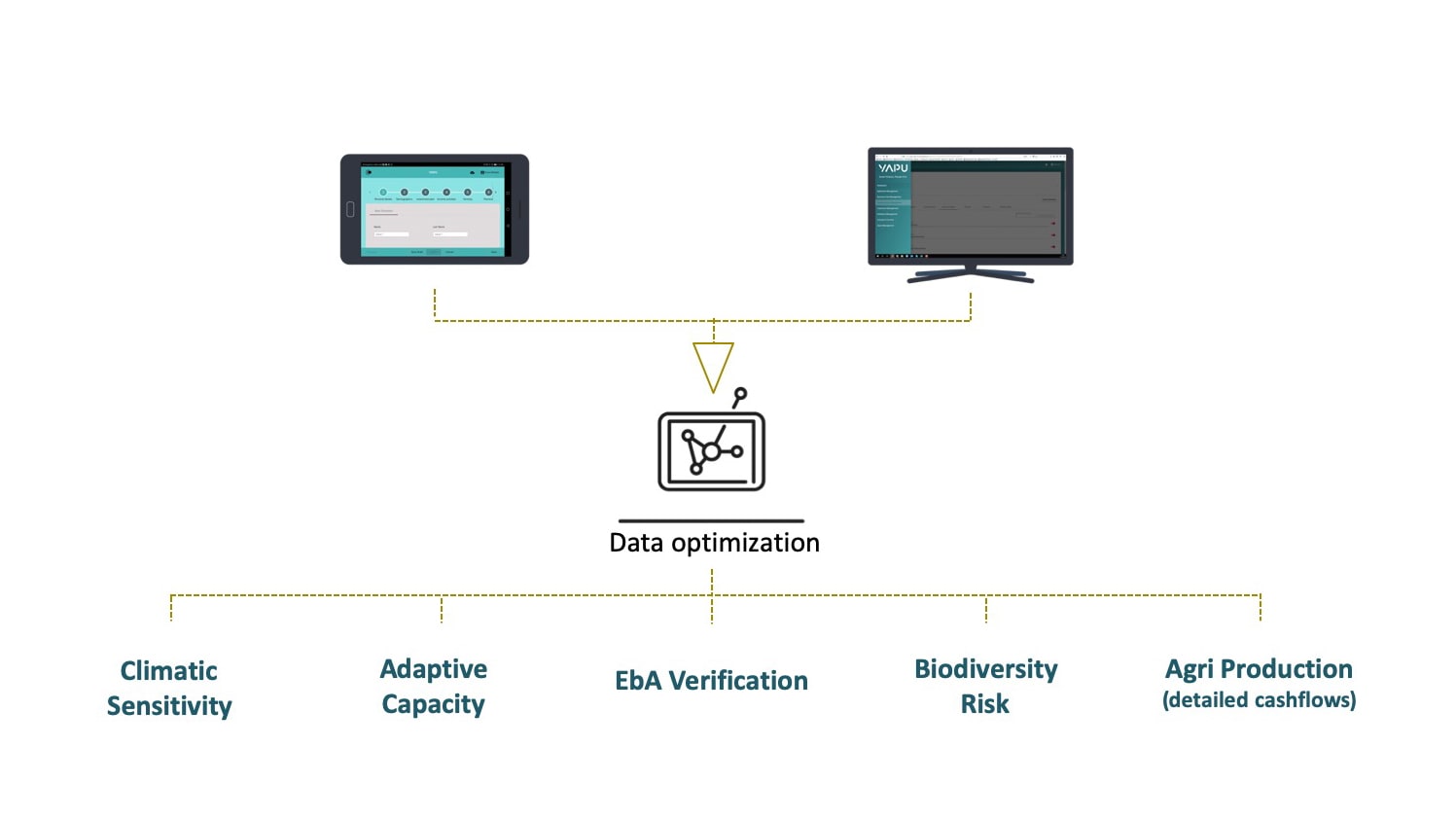

The MEbA Biodiversity Platform is an online tool that offers Financial Service Providers:

Biodiversity is a key component for agriculture finance.

A unique offer for Financial Service Providers

The FREE automated analysis contains

Adaptive capacity indicator

The Adaptive Capacity Indicator is based on a methodology developed by UN Environment Programme. It assesses the practices and technologies implemented by smallholders and thereby measures the capacity to adapt to climate change. The higher the adaptive capacity is the lower is the risk of vulnerability regarding climatic events.

Biodiversity indicator

The Biodiversity Indicator has been developed especifically for the MEbA Biodiversity Platform. It assesses whether practices and technologies implemented by smallholders carry the risk to contribute to the loss of biodiversity or, more favorably, are likely to contribute to biodiversity conservation and regeneration.

Green microcredit verification indicator

The Ecosystem-based Adaptation (EbA) Verification Indicator is based on a methodology developed by UN Environment Programme. It assesses if and to what degree the activities financed for a smallholder correspond to a green microloan. The characteristic of a green microcredit in this project is the reduction of climatic risk and/or the support of biodiversity conservation.

based on proven MEbA Methodology

The platform

The Platform generates Reports

Metrics produced by the BIOdiversity platform

The Biodiversity platform is an online tool which can be accessed by any computer via a web-browser or by android run tablet via a free app. It offers the possibility to enter a client declaration in a questionnaire and produce an automated report in an instant to add to FSP standard credit commitee report and enhance assesment. Calculations are done by the platform, which includes the full experience of the MEbA project in its analysis plus a new developed Biodiversity Indicator. The resulting report can easily by downloaded.

The integrated climate data and the biodiversity indicator will help institutions to embark in green inclusive finance, a field the initiative strongly supports. To support the further development of green inclusive finance, the MEbA Initiative is offering these advanced analysis possibilities to all interested Financial Service Providers in Latin America and Sub Saharan Africa for free until 15 February 2021.*

* Latin America: Colombia, Brazil, Mexico, Peru, Bolivia, Hunduras, El Salvador, Dominican Republic and Costa Rica

Sub Saharan Africa: Senegal, Ivory Coast, Benin, Burkina Faso, Rwanda

After 15 February 2021 a reasonable fee per analysis will be charged. There are no binding contractual obligations for the use of the platform involved at any time. All actvities and material will be provided in two languages: Spanish and French; the platform will be available in three languages: Spanish, French and Portuguese.

The Financial Service Providers with best environmental performance will be granted continuous free access to the Platform.

Presentation Launch Event

Please contact

biodiversity.platform@yapu.solutions

for details on project participation.